7 facts you must know before enrolling in Medicare

Here’s the scenario: You get halfway through age 64 and all of a sudden your mailbox starts getting filled up on a regular basis. Every insurance company you’ve ever heard of (and probably some you haven’t) wants to offer you their latest and greatest Medicare plans.

And God forbid if you enter your personal information online trying to get some research done – now your phone rings on a daily (hourly?) basis with agents calling who want to help you pick the latest and greatest Medicare plans.

The bad news is that there really isn’t a good way to prevent the mail part of this from happening. To stem the phone calls, avoid putting your name and phone number into any online forms. In this article, we will cover some additional points that you should be aware of before enrolling in Medicare.

You can also add your phone number to the Do Not Call Registry at 888-382-1222. This may or may not do much to stem the calls… but every little bit helps.

1. How to enroll – best to worst

If you are already collecting Social Security benefits you will automatically be enrolled in Medicare and other is nothing you have to do. Your first day of coverage will be the 1st of the month in which you turn 65. One exception to this is if your birthday is on the 1st of the month – in that case, your Medicare effective date will be the 1st of the month prior to your birthday month.

Example: Your birthday is May 1, 1957; your Medicare coverage begins on April 1, 2022.

If you are not yet collecting your Social Security benefits then you will have to enroll yourself in Medicare once you are within three months of turning 65. There are three ways to do this and they are listed here in the typical order of easiest to most painful:

- Online at https://www.ssa.gov/benefits/medicare/. Scroll down this page to How To Apply Online For Just Medicare and click on the Blue Button that reads Apply for Medicare only.

- By phone at 800-772-1213. This is the national number for Social Security and you should prepare for an extended hold period. If you are given the option of leaving your number and having them call you back, it’s generally best to take advantage of that.

- Schedule an appointment at a local Social Security office. Avoid this option whenever possible.

2. Medicare does not cover all medical care costs

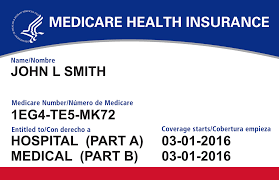

Original Medicare consists of part A, which covers hospitalization charges, and Part B, which covers doctor costs.

Both Part A and Part B only cover a portion of any charges incurred. Your financial exposure can (and should) be reduced by also enrolling in a traditional Medicare Supplement plan or a Medicare Advantage plan.

Medicare also does not cover prescription drugs, custodial care in a nursing home, or most dental, vision and hearing care.

A good independent broker can help you understand all of your options and reduce the overwhelming aspect of your transition to Medicare.

3. What Medicare costs

Most people get Part A at no cost because of paying into Social Security for 40 quarters (10 years). Having a spouse that has 40 quarters of tax-paying employment also satisfies this requirement.

Part B, on the other hand, carries a monthly premium which is $170.10 in 2022. The Part B premium is higher if your adjusted gross income is over $91,000 (individual) or $182,000 (joint).

If a person receives Medicaid, the Part B premium may be paid by the state.

4. You should buy Part D drug coverage, no matter what

Even if you are not currently taking any prescription medications, it is in your best interest to put a Part D drug plan in place. If you choose to wait, you will pay a monthly penalty for the rest of your life when you do need to get a drug plan.

Yes, it’s absolutely ridiculous. Unfortunately, it’s also absolutely true.

5. What if you have health insurance at work?

If you are on a group plan at work – or covered under a spouse’s group plan – you may want to wait to enroll in Medicare Part B and avoid paying dual premiums. Some things to consider in this scenario are:

- Compare medical benefits (out-of-pocket expenses, copays, etc).

- Compare the monthly premium costs of each option.

- Do you take high-cost medication?

- Is your spouse dependent on your group coverage?

The group plan must be deemed as Creditable Coverage to avoid a late-enrollment penalty for Part B and Part D.

It can be difficult to figure out all of the different variables at play in this type of scenario. The best advice is to find a good broker who has the experience to make sense of everything with you and determine which course of action is in your best interest.

6. Should you choose a Medicare Supplement or Medicare Advantage plan?

There are many differences between these two options and this is just a very brief overview. See this page for greater detail.

Traditional Medicare Supplement (Medigap):

- Carries a monthly premium typically ranging from $90-$140 (at age 65).

- Freedom to see any doctor in the country who accepts Medicare assignment.

- Doctor referrals are never necessary.

- Typically no copays (Plan N has limited copays).

- After a $233 deductible, coverage for Medicare-approved charges is 100%.

- No prescription coverage. Must have a standalone Part D plan in addition to the Medigap plan.

Medicare Advantage:

- Low to no ($0) monthly premium

- Typically restricted to in-network doctors. Some plans allow out-of-network care at a higher out-of-pocket cost.

- Varying copays for most healthcare services. Preventive/Wellness services are typically covered at 100%.

- Doctor referrals may be necessary.

- Most Advantage plans offer some form of dental, vision and hearing coverage.

- Most Advantage plans include Part D drug coverage.

7. Use an independent Medicare broker

An educated and independent broker will always work with your best interests at heart. We have over 12 years in the trenches helping people across the country make heads and tails of their many different Medicare choices.

When you choose to work with us it is vital to know that we do not look at our clients as a one-and-done type of transaction. Our service shines after you are enrolled in your Medicare plan. Any time you have a question, concern or issue, we want you to call us. Don’t try to figure things out on your own, don’t call the insurance company, don’t call Medicare – call us. We know our way around issues that will pop up and it’s much easier on your stress levels to let us help fix what needs fixing.

And you’ll never pay us a penny for our guidance!