Medicare Supplement vs. Medicare Advantage

The world of Medicare can be confusing and overwhelming. There are many different types and variations of plans to choose from. Therefore, you must understand the difference between a traditional Medicare Supplement and a Medicare Advantage plan. In this article, we will dig into the subject to better understand your many choices.

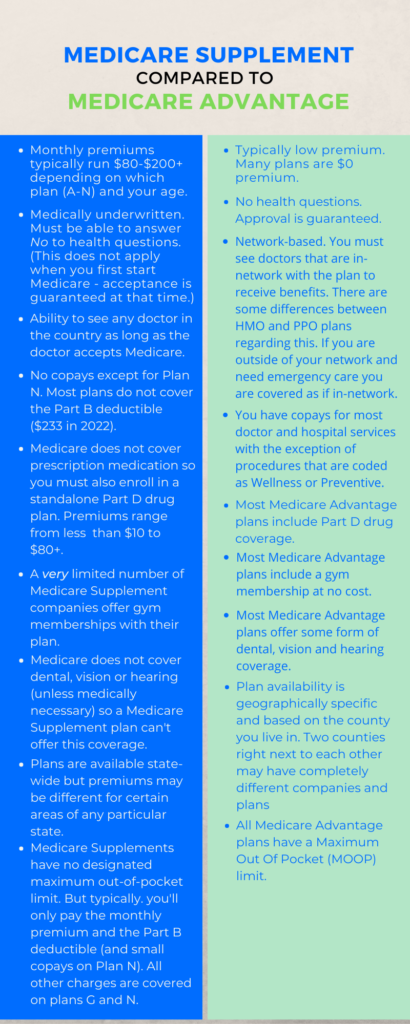

How are Medicare Supplements and Medicare Advantage plans different

Medicare consists of Part A (Inpatient Hospital) and Part B (Doctors, Outpatient procedures, durable medical equipment). Most people get Part A premium-free by having 40 quarters (10 years) of paying into Social Security. However, part B has a monthly premium of $170.10 in 2022. You must have Part A and Part B to enroll in a Medicare Supplement or a Medicare Advantage plan.

Broad Overview Of Medicare Supplements and Medicare Advantage

Medicare Supplements are also known as Medigap plans. We will refer to them as Medigap throughout this article. Medicare Advantage plans are also known as Part C plans. We believe that gets confusing with all the other Parts (A, B & D), so we will refer to them as Advantage plans.

Medigaps are offered by private insurance companies and are designed to fill the gaps in Original Medicare (hence the name). When you have a Medigap plan and incur a bill for healthcare, the claim is sent to Medicare which pays their portion of the charge. The remaining balance is sent to the Medigap company. Depending on which Medigap plan you have, you will most likely owe nothing on the original bill. You should not have any involvement with the claims process.

Advantage plans are also offered by private insurance companies. The big difference is that when you have healthcare charges, the claims are sent directly to the insurance company, and the company pays the claim. This is because the insurance company has a contract with Medicare and agrees to provide coverage that is at least as good as Original Medicare. In addition, the Advantage company receives a monthly allotment from Medicare for taking on the risk of the claims. This allotment from Medicare is what allows some Advantage plans to be $0 premium plans.

Enrollment in Medigap

When you first enroll in Part B and are age 65 or older, you are in the Medigap Open Enrollment Period. During this time you may buy any Medigap plan that is available in your state, no ifs, ands or buts. Once outside of the Open Enrollment window you may still move to a different Medigap company (for a lower premium, for example) if you can medically qualify. Each company has its own underwriting guidelines and you must be able to answer No to the health questions on the application.

Some states – California, Nevada and Oregon – Have a Birthday Rule. If you live in one of these states you have a 60-day window around your birthday to change Medigap companies with no questions asked. Each of these states have minor differences in how the rule is implemented.

In Missouri, you have the same 60-day window to change but it is based on the anniversary date of your existing policy.

Connecticut, Massachusetts, Maine and New York all have either annual or continuous guaranteed issue provisions for people on a Medigap plan.

Enrollment in a Medicare Advantage plan

Advantage plans have no medical underwriting. A person could literally be on their deathbed and enroll in an Advantage plan.

When your Medicare Parts A&B are initially effective you can sign up for an Advantage plan, regardless of what month it is. After that date, plan changes can be made during the Annual Enrollment Period which runs Oct 15 – Dec 7 of every year. The new plan will be effective on Jan 1 of the following year. This timeframe also applies to Part D drug plans.

In addition, if you have a Medicare Advantage plan (with or without Part D coverage) you can also make a plan change from Jan 1 – Mar 31. The new plan would be effective on the 1st of the month following the new application. This only applies to Advantage plans – not Medigap or standalone Part D drug plans.

To complicate things a bit more, there are certain Special Enrollment Periods (SEPs) that can occur throughout other parts of the year. If you are Dual-Eligible (meaning you have both Medicare and a certain level of Medicaid) you can make a change during the 1st three quarters of the year. SEPs can also be available if you qualify for Social Security Extra Help (LIS), are a member of a State Pharmaceutical Assistance Program (SPAP) and a number of other scenarios.

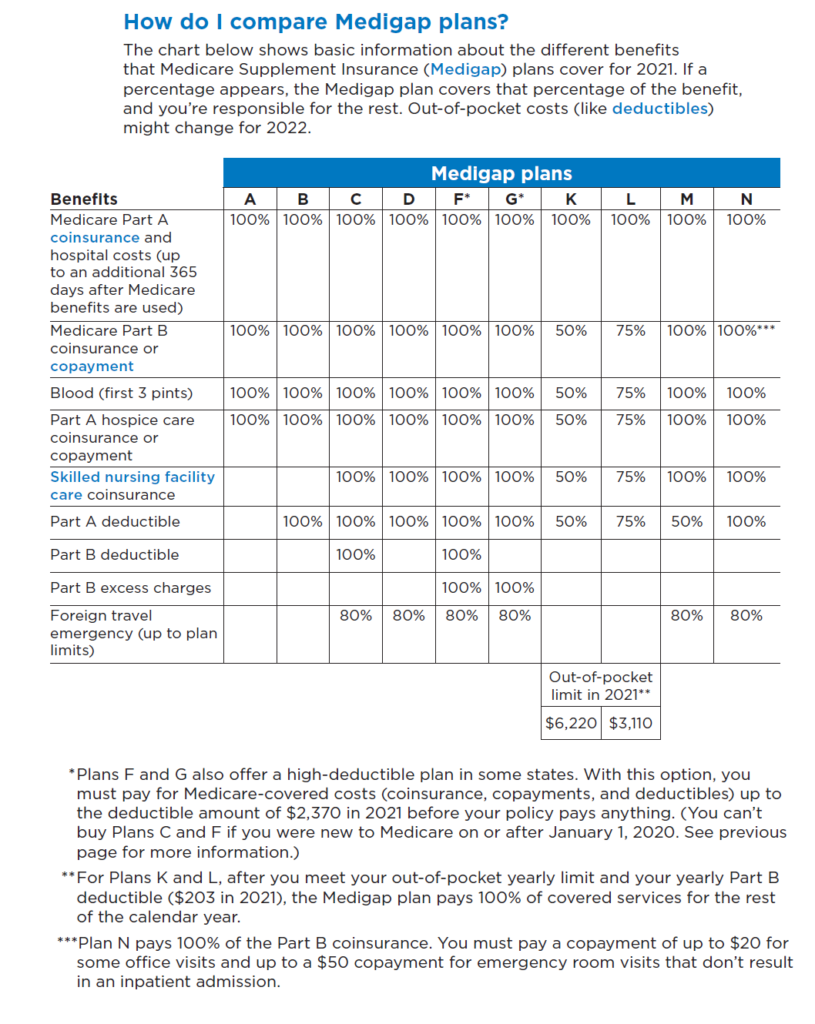

Plan Choices (Medigap)

Medigap plans are named by the letters A-N. Plans E, H, I and J were phased out in 2010 when all Medigap plans were standardized. Plans F and C are not available to anyone who became eligible for Medicare after January 1, 2020.

The following chart shows how each plan covers different Medicare gaps.

All companies that offer Medigap plans must offer at least Plan A, but they are not required to provide all of the other plan choices. The most commonly used plans are Plans F, G and N. Once again, Plans F and C are not available if you became eligible for Medicare after Jan 1, 2020.

Medigap plans do not cover prescription drug costs. If you choose a Medigap plan, you must also enroll in a Part D drug plan or face a penalty Premiums for Part D plans range from less than $10 to over $100. Consult with a professional that has access to all available plans and can tailor the coverage to your specific needs.

Medigap plans have no networks, and you can see any healthcare provider who accepts Medicare, no questions asked. No referrals are necessary. If you live in Rhode Island and want to see a cardiologist in Butte Montana, just pick up the phone and make an appointment.

Medigaps are Guaranteed Renewable. This means that you cannot lose your plan for any reason except for non-payment of premium.

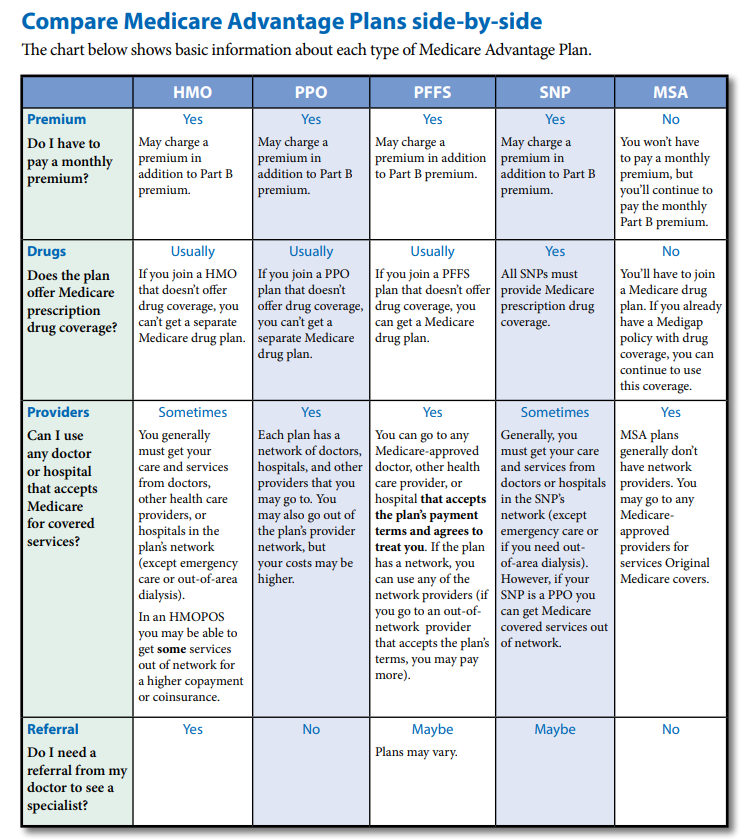

Plan Choices (Advantage)

Your choices of Advantage plans are based on the county in which you reside. This is true for every state in the country.

Advantage plans are offered in a variety of options:

- MA – Medicare Advantage (No drug coverage). HMO or PPO network

- MAPD – Medicare Advantage with Part D drug coverage. HMO or PPO network

- PFFS – Private Fee For Service

- SNP – Special Needs Plan. Usually an HMO network

- MSA – Medical Savings Account (No drug coverage and generally no network limitations)

Not all plans are offered by all companies. PFFS plans are a bit outdated and not very common anymore. MSA plans are fairly new and haven’t yet gained a lot of traction across the country. That being said, an MSA plan can be an excellent solution for some particular situations.

The vast majority of Advantage plans used today are the MA, MAPD and SNP plans. The majority of these plans will include additional benefits, such as dental, vision, hearing, free gym memberships and over-the-counter allowances that original Medicare does not cover. We’ll look at these a little more in-depth here.

Medicare Advantage (MA)

- These plans have doctor and hospital benefits but no drug coverage. Primarily, this type of plan is designed for a person who gets their prescriptions filled through the VA or Tricare. This is not a suitable plan option for someone who doesn’t have creditable drug coverage elswhere. Some of these MA plans have a Part B Giveback benefit. This benefit returns a portion of your Part B Premium – $148.50 – to you. The benefit amount typically runs between $40-$120, depending on the plan. MA plans can be either HMO or PPO plans

Medicare Advantage with Part D (MAPD)

- MAPD plans are Advantage plans that include drug coverage. These plans are, by far, the most common Advantage plans in use. Doctors, hospitals and pharmacies are all covered in one program. As with the MA plans, MAPDs offer additional benefits that you won’t get with original Medicare. MAPDs will use either HMO or PPO networks.

Special Needs Plans (SNP)

Special Needs Plans are either D-SNPs, C-SNPs or I-SNPs. SNPs as a whole reduce, sometimes significantly, the out-of-pocket costs to the plan member.

- Dual Eligible Special Needs Plans (D-SNP)

- These plans are available for people who have both Medicare and Medicaid. Some plans require a certain level of Medicaid to qualify for enrollment. DSNPs coordinate your care between Medicare and Medicaid and also offer social services as applicable. All D-SNPs include Part D drug coverage and are typically HMO networks.

- Chronic Condition Special Needs Plans (C-SNP)

- C-SNPs are only available to people that have a covered chronic condition such as diabetes, cardiovascular disorders, chronic lung disorders, etc. Not all chronic conditions have C-SNPs designed for them and plan availability varies depending on where you live. C-SNP plans are tailored to provide focused care for the qualifying condition. C-SNPs include Part D drug coverage and are typically HMO networks.

- Institutional Special Needs Plan (I-SNP)

- I-SNPs are designed for people who live in an institutionalized setting, such as a nursing home or other long-term care type of facility. These plans are designed to provide, as much as possible, all patient care in one location. Part D coverage is always a part of an I-SNP and the plan will be an HMO network.

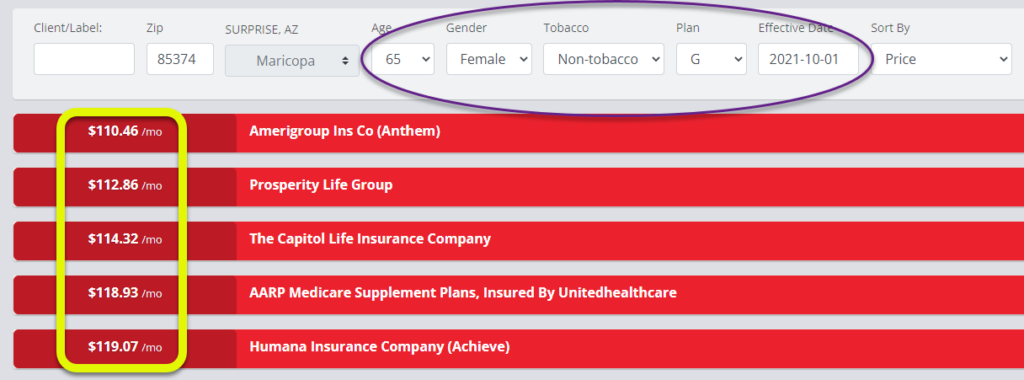

Premiums and costs for Medigap plans

Medigap plans were standardized in 2010. This standardization means that coverage will be the same for any given plan (A-N) regardless of which insurance company it comes from. However, the monthly premiums will vary significantly for the same plan from company to company.

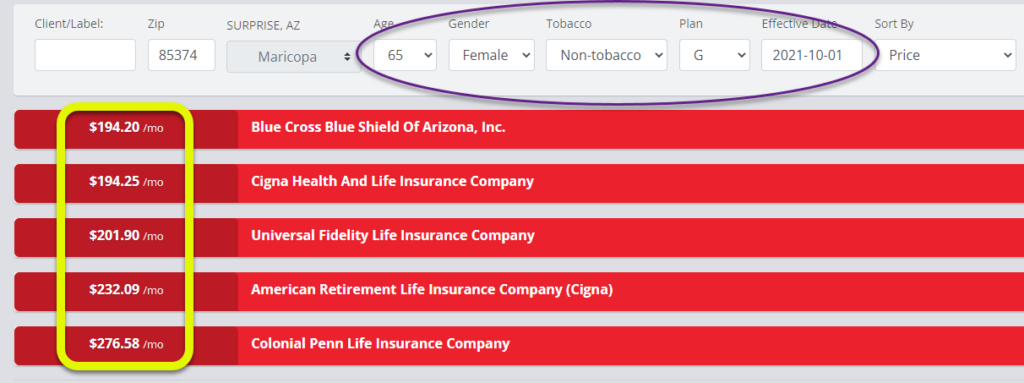

For example, we’ll look at the differences in premiums for a 65-year old female in Phoenix AZ, for a Plan G with an effective date of October 1, 2021. We’re only showing the lowest and highest five premiums as there are over 40 different quotes for this make-believe individual.

As you can see, the highest premium option is 2 1/2 times greater than the lowest premium. Remember that the coverage is the same by law. When you buy a Medigap policy, make sure that you work with someone who can compare all the different insurance companies. No one should pay more than is necessary – it’s just a waste.

As far as non-premium costs go with a Medigap plan, it’s pretty simple.

- Plan F: Covers all of the healthcare expense gaps in original Medicare. Your only out-of-pocket costs for Medicare-approved healthcare is the monthly premium. Plan F will always be the highest premium of all plan choices.

- Plan G: Identical to Plan F with one exception – Plan G does not cover the Medicare Part B annual deductible which is $233 in 2022. So your out-of-pocket costs on a Plan G is the 1st $233 in doctor expenses plus the monthly premium. Typically, the lower premium for a Plan G (compared to Plan F) more than makes up for Part B deductible.

- Plan N: Like Plan G, Plan N does not cover the Part B deductible of $233. It also does not cover Part B Excess Charges. If you see a doctor who does not accept Medicare assignment you may be charged up to 15% over the Medicare-approved amount for the visit/procedure. On Plan N you also have a copay when seeing your doctor of up to $20 and an emergency room copay of up to $50. Plan N will have the lowest monthly premium of these 3 plans.

Premiums and costs for Medicare Advantage plans

Advantage plans aren’t nearly as clear-cut as Medigap plans. For example, HMO plans require that you receive all care only from their in-network providers. PPO plans allow you to see out-of-network providers, but your out-of-pocket costs will be higher for that.

Regardless of the plan network, if you need emergency or urgently necessary care while out of town, you are billed as if you are in-network.

Many, but not all, Advantage plans are $0 premium in 2022.

Except for healthcare coded as Preventive or Wellness, you will have a copay for most care received from an Advantage plan. Preventive/Wellness care would be something like a flu shot or an annual wellness checkup. A colonoscopy can even be coded as a Wellness procedure and carry zero out-of-pocket cost. However, if a polyp is found during the exam and removed, it would then be coded as an outpatient procedure, and you would pay the appropriate copay.

Advantage Plan Copays

Every Advantage plan across the country (over 3500 in 2022) has different copays for different scenarios. A very generalized typical copay schedule would look something like this (this example does not contain all of the covered benefits with an Advantage plan and is for informational purposes only):

- Primary Care Physician: $5

- Specialist: $45

- Inpatient Hospitalization: $300/day for days 1-5 (No daily copay after day 5)

- Outpatient Procedure: $250

- MRI/CT Scans: $325

- Emergency Room: $120

- Chemothereapy/Radiation: 20% of the Medicare approved amount

All Advantage plans have a Maximum-Out-Of-Pocket (MOOP) dollar figure. For 2022, that number cannot be higher than $7550 for in-network care. The most commonly used plans have a MOOP that is lower than $7550. Since PPO plans allow you to receive care out-of-network, they will have two different MOOPs; in-network and out-of-network.

If you hit the MOOP, you would have no more out-of-pocket costs for the remainder of the calendar year.

Advantage plans may require prior authorization for certain procedures and medications. They may also require a referral to see a specialist. Certain procedures may be denied if the Advantage company wants your doctor to try a different treatment first.

Additional Benefits

The majority of Advantage plans offer benefits that Original Medicare does not. For example, plans may include:

- Dental

- Vision

- Hearing

- Free gym membership (There are a couple of Medigaps that also offer a gym membership)

- 24/7 Nurse Hotline

- Over The Counter (OTC) Benefits

- Transportation Benefit

Wrapping things up

As you can see, there many differences between Medicare Supplements (Medigaps) and Medicare Advantage plans. However, both options are designed to limit the financial exposure you would have with just Original Medicare – they simply go about it in entirely different ways.

- With a Medigap, you pay your monthly premium (whether you see a doctor or not) and are pretty much covered for everything Medicare-related after the Part B deductible is satisfied.

- Anecdotal note: We had a Medigap client in Missouri who was diagnosed with brain cancer. She opted to receive care at MD Anderson Cancer Center in Houston TX. Her stay exceeded 2 months and her only out-of-pocket cost was the monthly Medigap premium. She likely would not have had the option of that treatment center had she been enrolled in an Advantage plan.

- With an Advantage, you’ll possibly have no monthly premium, and it’s a pay-as-you-go type of scenario.

We are often asked which choice is the best

The honest answer is there is no one-size-fits-all solution, and both plans have their own pros and cons.

Your best bet is to consult with a professional who has access to all the different companies and plans available in your area. You should be asked to provide your concerns and goals. If you are interested in an Advantage plan, you should be asked to provide the names of your doctors to ensure they are in-network with any recommended plan.

Your prescriptions should also be factored into the equation as drug coverage varies from plan to plan.

We know how complicated and confusing Medicare choices can be, and we hope this has helped shed some light on the subject. There is a lot of misinformation out there and it’s very easy to overpay for your Medicare choices simply because you don’t have the necessary knowledge on the subject.

Please feel free to contact us for answers to your particular questions.

1 Comment

7 facts you must know before enrolling in Medicare – Horton & DeLoach Insurance Brokerage

[…] are many differences between these two options and this is just a very brief overview. See this page for greater […]