How to best use your Medicare Part D Plan

When it comes to Medicare Part D drug plans, there are many factors to consider. What’s your budget? How much do you need in prescription coverage? Are all of your drugs covered? How will this plan affect your finances and lifestyle if you’re a senior living on a fixed income or with limited savings?

The key is figuring out which plan works best for you, which can change year by year. We’ve written this article to help answer some of these questions and provide resources for folks who want more information about their options for choosing the right Medicare Part D drug plan.

We’ll start with basic background information on Part D plans and then move into how to make sure you are getting the maximum benefit possible for your prescription costs.

Part D history

Medicare started in 1965 and was designed to cover hospitalization (Part A) and doctor visits (Part B). Therefore, prescriptions used in those settings were covered by Medicare. However, it did not cover retail costs (filling a prescription at your local pharmacy). On January 1, 2006, the Medicare Part D benefit was introduced to make out-of-pocket costs more affordable.

According to the Kaiser Family Foundation: A total of 48 million people with Medicare are currently enrolled in plans that provide the Medicare Part D drug benefit, representing more than three-quarters (77%) of all Medicare beneficiaries. (June 8, 2021)

To enroll in a standalone Part D drug plan, you must have Medicare Part A or Part B. This is different from enrolling in a traditional Medicare Supplement or a Medicare Advantage plan for which you must have both Parts A&B. If you enroll in a Medicare Advantage plan, it will likely have Part D coverage incorporated into it.

- There are Advantage plans with no Part D coverage.These plans are typically only used by someone who gets their prescriptions filled elsewhere, e.g. with VA benefits. If you are trying to do this all on your own be aware that such plans do exist. You certainly do not want to find out the hard way that you have no prescription coverage!

How Medicare Part D plans are structured

Part D plans are all offered through private insurance companies, just like Medigap and Advantage plans. Each plan consists of a formulary that lists all of the meds that the particular plan covers. Prescription drugs in the formulary are arranged by tiers which will look like this:

- Tier 1 – Preferred Generic

- Tier 2 – Non-Preferred Generic

- Tier 3 – Preferred Brand Name

- Tier 4 – Non-Preferred Brand

- Tier 5 – Specialty Drugs

Each tier has an impact on your cost-sharing. So to keep it simple, remember – The higher the tier, the higher your copay. Medications can be on different tiers from company to company. Sometimes even on different tiers on other plans from the same company.

Formularies may vary from plan to plan, but they all must cover a wide range of drugs and contain at least two medications from the most prescribed categories.

If you take a drug not on the formulary, you can ask for an exception, file an appeal or pay out of your pocket. A generally better choice is to not enroll in a plan that does not cover all of your meds whenever possible.

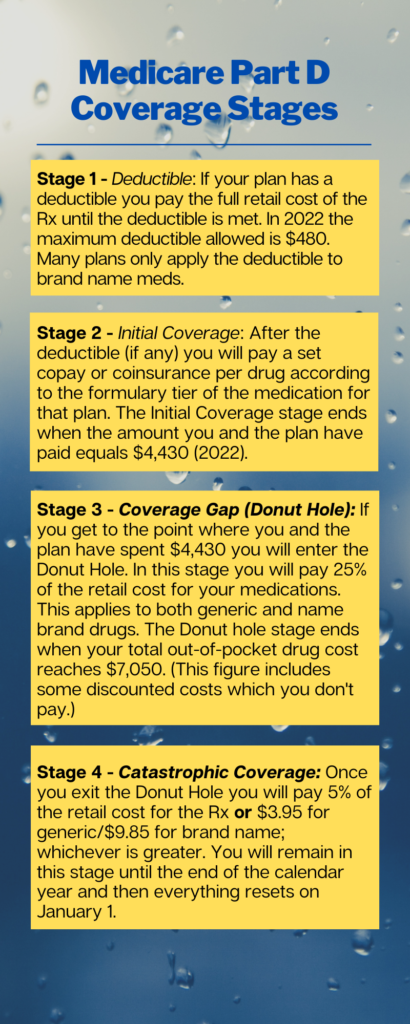

The Donut Hole

It doesn’t matter if you have a standalone Part D plan or an Advantage plan that includes Part D coverage – they are all subject to the same conditions that lead up to the Donut Hole.

Usually, you want to avoid reaching the Donut Hole stage or at least put it off as long as possible. This is because having to pay 25% of the retail cost of a higher-priced drug will typically be more than what the copay was before the Donut Hole.

Find your correct plan here

One of the services we offer is a full breakdown of all plans that are available to you. More importantly, we filter the plan choices by your specific medications and find the lowest expected out-of-pocket solution for you. In many areas of the country, there are over 30-40 different Part D and Medicare Advantage plans to choose from. Are you confident in your ability to pick the best plan for your pocketbook or wallet?

Go to our secure and encrypted Plan Compare page and follow the simple instructions (start by watching the short instructional video). Once you have entered all of your Rx give us a call or text with your personal code and we will put together all of your options so you are able to make a properly-educated decision.

As with all of our services, there is no charge for this resource.

LEP and IRMAA

Late Enrollment Penalty (LEP)

When Part D coverage started in 2006, a Late Enrollment Penalty was included as part of the package. In plain language, it states that:

- anyone eligible for Part D coverage (meaning, you have Medicare Part A or Part B)

- and who does not enroll in a Part D plan within 63 days of eligibility

- will pay a Late Enrollment Penalty if they don’t have other Creditable Coverage at that time.

The penalty is calculated as follows:

- Take 1% of the national base beneficiary premium (the average premium of all Part D plans nationwide);

- Multiply that figure by the number of months you could have had Part D coverage and didn’t.

- The resulting product (rounded to the nearest $0.10) is the amount of the LEP and is added to the plan premium.

In 2022. the average national premium is $33.37. 1% of that is $0.33. So, for example, if a person went five years without Part D coverage, they would incur a penalty of 60 months times $0.33, which would be $19.80. That is a monthly penalty that is added to the plan premium.

The LEP amount is recalculated every year as the national average premium changes.

The LEP will occur (or recur) whenever you go without creditable drug coverage. For example, if you have a break in coverage – greater than 63 days – for any reason.

The LEP never goes away. Once you have it, you’re stuck paying it as long as you are enrolled in Part D coverage.

- Exception to the above – If a person has Medicare due to receiving Social Security Disability benefits and is under age 65 and is paying a late enrollment penalty, when they turn 65 the slate is wiped clean and the LEP disappears.

- Also, if you are receiving Social Security Extra Help (LIS) you are not liable for a Part D LEP. If you were already paying a Part D LEP and then qualified for Extra Help, the LEP goes away.

In our view, the LEP is ridiculous the way it’s set up. However, our opinions don’t mean squat when it comes to the actual reality of the ridiculousness.

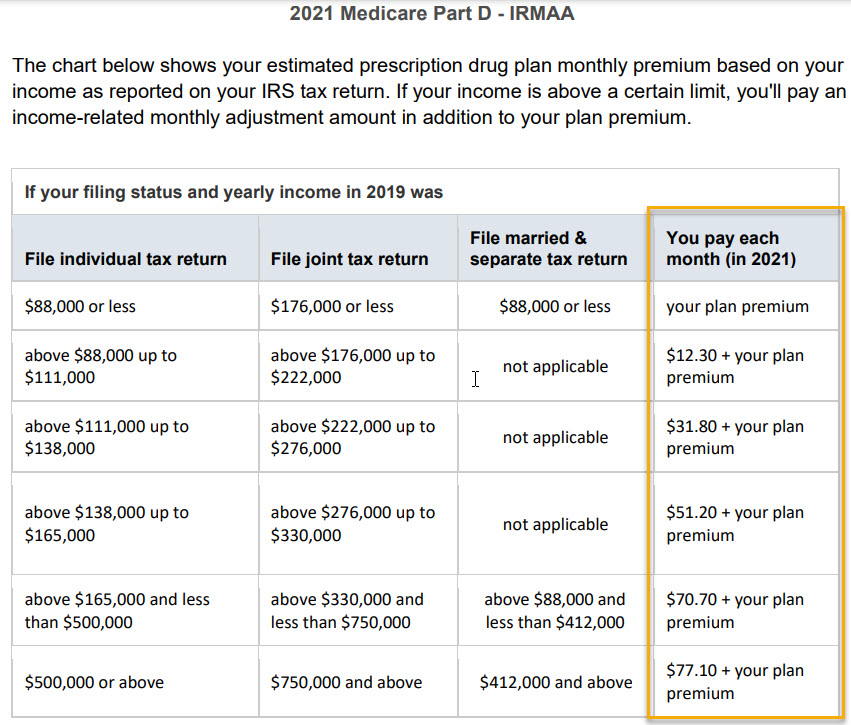

Income Related Monthly Adjustment Amount (IRMAA)

IRMAA is another penalty that can be applied to Part D plans. This surcharge is based on your household income. Your tax returns from 2 years prior are used to determine if IRMAA will apply to you. This chart breaks down the figures for 2021 and will be updated when Social Security releases the figures for 2022.

As you can see, if your income was less than $88K ($176K for married), you will have no IRMAA surcharge.

The IRMAA can get tricky because Social Security bases the charge on income from the past. For example, we have had situations where a client received an out-of-the-ordinary windfall (taxable inheritance, stock option redemption, etc.) 2 years before, which jumped their reported income far out of their normal income range and triggered the IRMAA charge. Or, let’s say you just retired from your high-paying job, and your current income is nowhere near what it was when you were working.

In these types of situations, you would file a dispute – Form SSA-44 – with Social Security and have the IRMAA adjusted accordingly or taken away entirely.

How to potentially cut your Rx costs

We are continually on the lookout for ways that our clients can save money on their prescription costs. Here are some strategies and programs that we utilize whenever possible.

Social Security Extra Help

Commonly known as just Extra Help, this is a program through Social Security for people with limited income and assets that meet the program guidelines. Once approved for Extra Help, your Part D premiums, deductibles and copays are all capped at a specific dollar amount. For example, your Rx copays could be as low as $3.70 for generic meds and $9.20 for brand-name drugs in 2021. You can apply by phone, online or in-person at a local office. We highly recommend applying online. It’s a simple application and much easier than making an appointment or waiting on hold for an hour on the phone.

If you need help with this, give us a call, and we can complete the application with you.

Patient Assistance Programs

The majority of drug manufacturers have assistance programs available for certain medications. We look for help here if a client has a high-priced med and the out-of-pocket cost is tough on the budget.

Every manufacturer has different guidelines, but most of them are income-based. Surprisingly, some of the income limits are incredibly generous. We’ve helped clients get approved for assistance with incomes over $50K.

Choose either search option and pull up the medication you are looking for. It will show you the manufacturer of that drug and all available program options and applications. If you are approved, you will receive the medication at no cost for the remainder of the year.

Sidenote: We cannot say with certainty that every single program provides no-cost drugs for approved individuals. We can confidently say that this has been the outcome for every case we have helped clients with over the years.

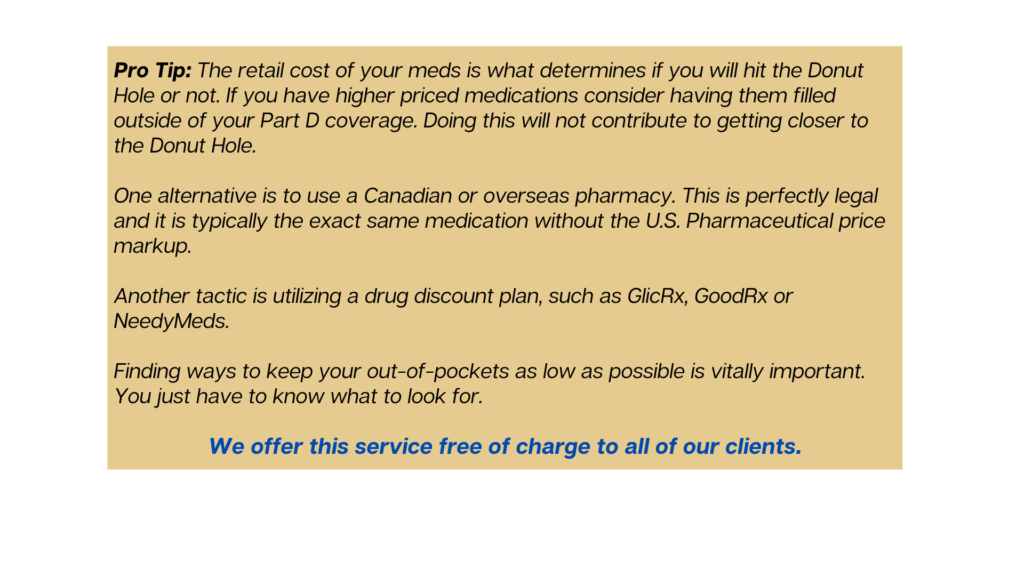

Drug discount cards

These cards can make quite a difference in your out-of-pocket cost at the pharmacy, but they’re not great for every single drug.

The best way to use them is to plug a medication into the app (or on your computer) and see what pricing looks like for various local pharmacies. If you can get a medication cheaper with the discount card, use it. If the same drug is cheaper on your Part D plan, use that.

Prescription discount cards should not charge you a fee to use them.

Any prescriptions filled using a discount card will not count towards the donut hole threshold on your Part D plan.

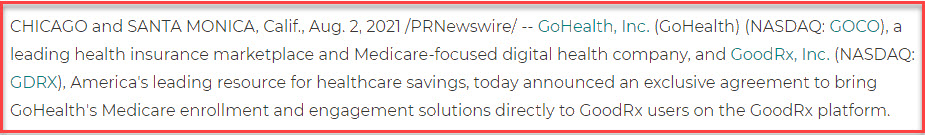

GoodRx is likely the most well-known discount card in the country, and we have directed clients to them for years. However, in August 2021, GoodRx entered into an agreement with GoHealth. GoHealth is a huge nationwide health insurance marketing organization, and its main business focus is on Medicare beneficiaries.

What this news release is saying, in plain English, is that GoodRx is giving their registered customer’s information to GoHealth for marketing purposes. In even plainer English, if you register an account with GoodRx, you should probably expect a phone call from a GoHealth representative in an attempt to get your business.

Our advice: Feel free to use GoodRx still if it helps you save money. Just do not sign up for an account with them. Unless you enjoy phone calls from strangers.

Another strong discount card provider is GlicRx. We have been utilizing their service even more since the GoodRx/GoHealth partnership. GlicRx does not sell your information, and we believe that is extremely important. You can download the app at GlicRx. If the app asks for an access code, use SRX522, and we will be recognized as an authorized agent and can assist you with any questions and/or guidance.

Insulin Savings Program (ISP)

Technically known as the Part D Senior Savings Model, this program helps Medicare folks with their insulin costs. Enacted on January 1, 2021, the ISP limits the cost of certain insulins to no more than $35 for a 1-month fill. The program is an integral part of specific standalone Part D and Medicare Advantage plans with Rx coverage.

Not all insulins are covered, but a large number of them are. The insulins covered can vary from plan to plan.

In our not-so-humble opinion, the cost of insulin is criminal, and most people who take it will enter the Donut Hole every year. However, the $35 cost limit with the Insulin Savings Program applies even during the Donut Hole! Insulin copays while in the Donut Hole can run beyond $200. Utilizing the benefits offered by the ISP can indeed be a game-changer for some folks!

If you have diabetes and are prescribed insulin, it is well worth your time to see if a plan like this is available to you.

Overseas Pharmacies

We have many clients who choose to get certain prescriptions from outside of the U.S. because it just makes good financial sense. Whether from Canada, Great Britain, New Zealand… it really doesn’t matter as long as it’s the same drug and same manufacturer but you’re paying pennies on the dollar compared to filling it locally.

You can Google Canadian online pharmacy or overseas online pharmacy if you feel the need to do your own research. An easier way is just to call us – we’ve done this a time or two.

We’ve covered a lot of ground in this article. We hope you have found a tidbit or two that is helpful. We’ve said it before, and we’ll say it again – this stuff is complicated, and they really don’t make it easy to understand. We are always happy to answer your questions and offer guidance.